Ensuring patients get the right care at the right time in the right place while reducing administrative costs will require streamlined processes for prior authorization and medical necessity.

Previous attempts at simplification haven’t gained meaningful traction or industry adoption — HIPAA EDI 278 transactions haven’t led to solutions as hoped.

It’s simply taken way too long to figure out how to effectively manage authorizations. But there are strategies that are showing promise.

At the foundation of these strategies is payer/provider collaboration.

Chief financial officers and managers can work together with their payer/provider partners to define and deploy solutions aimed at reducing inefficiencies that delay timely care and lead to unnecessary denials that impact the bottom line.

Prior authorization processes today

We have worked on both sides of the payment equation and understand why payers, providers and even patients struggle with prior authorization and medical necessity. There is not yet a commonly adopted industry solution.

In recent years, there has been a substantial increase in scrutiny around care, primarily from a cost/benefit standpoint.

However, prior authorization confusion and inefficiency is driving much more than just cost: It’s a roadblock to improving the overall health care system.

Part of the problem is that each step — determining whether a service needs prior authorization, finding the right documentation and then submitting the request and waiting for approval — is often a manual process.

Some provider/payer interactions still take place via phone or fax. Under the best circumstances, payers provide an electronic portal for submitting requests.

But even in those cases, providers must log into each individual payer website to fill out forms, and then go back into the system to determine if a decision was made.

These processes are time-consuming and administratively expensive and can negatively impact operational efficiency. These inadequacies become even more costly and problematic downstream.

The impact on finance

On the provider side, if a claim is denied after care has already been provided without an authorization, thousands of dollars’ worth of services may be written off.

For payers, an inefficient prior authorization process reduces opportunities to address care variation, site of service and over-utilization.

Both sides deal with the administrative and clinical expenses associated with appeals.

Pre-authorization impacts the patient and ultimately puts them in the middle of a financial struggle. A patient may experience delays in getting access to medications and therapies, creating a deficit in patient experience that will be difficult to overcome.

Process improvement

How can CFOs at payers and providers establish an equitable, mutually beneficial prior authorization process?

It can start with relationships built on an understanding of shared risk. Through partnerships, groups can build the trust needed for efficient communication, data sharing and transparency.

Any time a relationship between a payer physician advisor and a provider group is established, there’s a process of mutual education that takes place.

Providers can better understand how to submit pre-authorization requests, while payers can use their administrative resources to simplify the process.

Both sides can work to establish a better exchange of information related to appropriate care guidelines; insight into standards for referrals including pricing, quality, availability and proximity; and engaging the patient with their options.

Also important are honest discussions on what has been denied in the past, or what has created an inefficient process of negotiation after the fact.

Once payers and providers agree on what they need to know, leaders can utilize electronic communication and data mining tools to create channels for information exchange and discovery.

Applying emerging technology

Artificial intelligence will play a role in this process. With prior authorization rules in place and thousands of transactions to model, AI can guard against denials due to administrative oversight, such as the wrong medical code or missing paperwork.

AI can also allow for the automation of typical or straightforward submissions, freeing up staff to focus on more complex cases.

Removing person-to-person interaction altogether is unlikely in a high-touch industry like health care. It’s too difficult to foresee all possible negotiations on the clinical efficacy of treatment.

But AI can help drive consistency for issues that are well known to both payers and providers — like the most common higher-volume treatments that are likely to get denied without prior authorization.

Auto-approvals in use

Comprehensive solutions that allow for auto-approvals can help payers and providers stay current on rapidly changing care guidelines and approved therapies.

For example, the Optum Medical Benefit Management Cancer Guidance Program currently auto-approves 64% of all requests.

Auto-approvals happen when the provider chooses a cancer treatment in alignment with evidence produced by groups such as the National Comprehensive Cancer Network (NCCN).

A clinical team on a one-on-one basis reviews requests that cannot be auto-approved.

CGP encourages providers to prescribe the highest quality, most cost-efficient treatment. This results in savings for payers, and better outcomes for members.

Payer/provider partnerships

Improving prior authorization processes will require workflow integration between payer and provider systems to clear barriers to implementation.

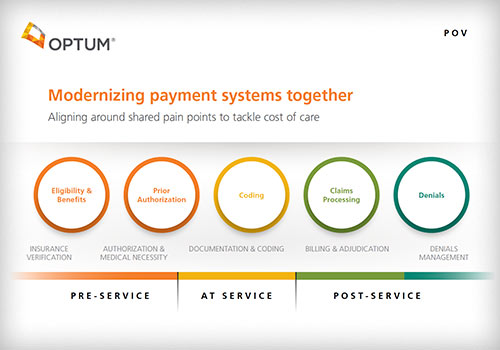

By improving access to information and automating key functions, financial leaders can help move the authorization process earlier in the payment continuum — to the point of care — reducing the risk of denials and positively impacting the revenue cycle.

A streamlined process will also improve patient experience and satisfaction, which should boost loyalty, create opportunities for engagement and preventive health, and reduce costs in the long run.

Eileen Russo, PhD

Optum Advisory Services

Eileen Russo, PhD, is practice lead for revenue cycle management at Optum Advisory Services. She focuses on helping health care executives develop strategic responses to emerging trends and market forces. Prior to joining Optum, Eileen held executive leadership roles at The Advisory Board.

Brandon Childs

Vice President, Optum Advisory Services — Payer-Provider Collaboration

Brandon Childs works within the Optum Advisory Services Payer-Provider Collaboration team. He brings more than 28 years’ experience with both payers and providers building and operationalizing solutions that help improve health care.

Tag: Articles and blogs, Executive Insights, Financial Leaders, Finance